Last updated 21 April 2020

Enrolment is now open for the Australian Government's JobKeeper payment. Visit the ATO website for further info.

Church Giving & Finances

Church Financial Giving during COVID-19

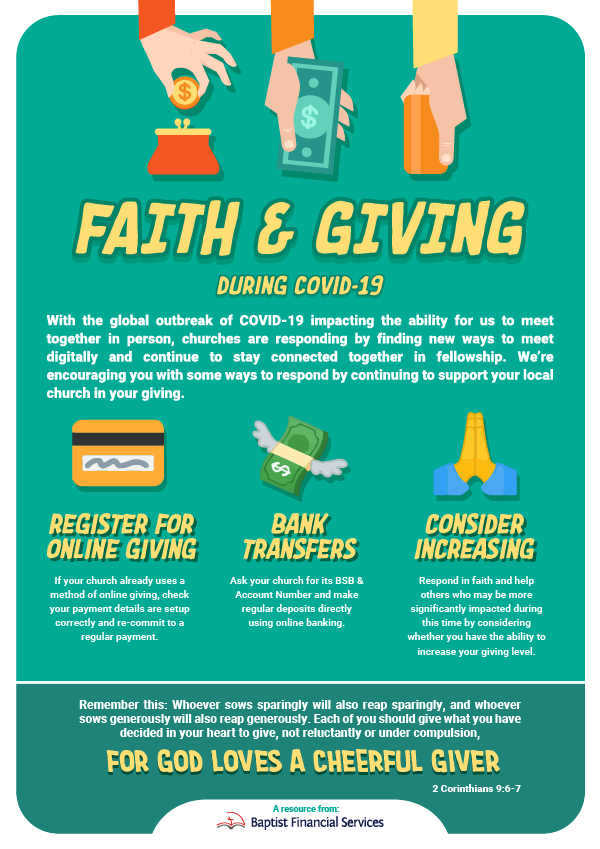

Some churches and ministries already receive all or most of their income, offerings and donations electronically whilst for others this is not the case. We encourage your church and ministry to communicate at this time with your congregations, members or supporters to encourage giving by electronic methods and to highlight methods by which they can continue to support your church or ministry.

The simplest and most immediate way for your organisation to receive gifts electronically is for you to share your organisations BSB and Account Number with your members and ask them to send their gifts to your organisation’s account directly. Most banks and financial institutions offer many online methods to do this from internet banking to mobile banking apps.

The simplest and most immediate way for your organisation to receive gifts electronically is for you to share your organisations BSB and Account Number with your members and ask them to send their gifts to your organisation’s account directly. Most banks and financial institutions offer many online methods to do this from internet banking to mobile banking apps.

We’ve put together a Faith & Giving during COVID-19 Handout you can share with your church members.

Loan Repayments with BFS

Our purpose and focus remains to support churches and ministries through this situation. If you have financial concerns, or difficulties meeting loan repayments, please contact your Relationship Manager so we can be aware of your situation and can support you at this time.

Please find further information in the attached documents:

Request for Loan Repayment Accommodation for COVID-19

Cashflow Template Spreadsheet

To further assist during this time, our variable interest rates have been reduced for clients with loans. Correspondence about lowered minimum repayments has been sent to all relevant loan clients with information specific to their new arrangements. You can view our revised interest rates on the Rates & Fees page

Please find further information in the attached documents:

To further assist during this time, our variable interest rates have been reduced for clients with loans. Correspondence about lowered minimum repayments has been sent to all relevant loan clients with information specific to their new arrangements. You can view our revised interest rates on the Rates & Fees page

Faith & Giving in Australia Research Report

We encourage you to view and share with your congregation, members or supporters our Faith & Giving in Australia research report, which we trust you will find it encouraging at this time.

A short highlights video and the full report are available below.

A short highlights video and the full report are available below.

Australian Government Financial Support Programs

Boosting Cash Flow for Employers

Provides up to $100,000 back to small and medium-sized businesses, with a minimum payment of $20,000 for eligible businesses. The payments will provide cash flow support to businesses with a turnover of less than $50 million and not-for-profit entities that employ staff. The payment will be tax free.

JobKeeper Payment

15 April Update: Charities registered with the ACNC are eligible for JobKeeper payments if they can show a reduction in revenue of 15%. For other businesses this reduction in revenue remains at 30%.

Under the JobKeeper Payment, businesses impacted by the coronavirus will be able to access a subsidy from the Government to continue paying their employees. Affected employers will be able to claim a fortnightly payment of $1,500 per eligible employee from 30 March 2020, for a maximum period of 6 months.

Under the JobKeeper Payment, businesses impacted by the coronavirus will be able to access a subsidy from the Government to continue paying their employees. Affected employers will be able to claim a fortnightly payment of $1,500 per eligible employee from 30 March 2020, for a maximum period of 6 months.

Government Support Churches & Charities Summary by Saward Dawson

Saward Dawson have put together a summary of various support applicable to churches and charities.

Other Resources

Information and Resources from Australian Charities and Not-for-profits Commission (ACNC)

Please refer to the ACNC's COVID-19 information page for relevant information helpful to charities.

Australian Government mobile apps

We encourage you to download the official government “Coronavirus Australia” app in the Apple App Store or Google Play, or join the WhatsApp channel on iOS or Android.

Webinar - Charities, ACNC & COVID-19

Joint webinar with ACNC and the ATO. Providing an overview of the Federal Government's recently announced support for the charity and NFP sectors, as well as cover issues of charity regulation in a time impacted by COVID-19. Filmed 30 March 2020

Contacting BFS

We're here to help you.

In line with the government recommendations, we have asked our teams to work from home. We are sure you will support us in our efforts to keep our staff and their families and communities safe. The best way to contact us is to email us at clients@bfs.org.au. You may also be able to find the information you need here on our website.